All Categories

Featured

Table of Contents

Variable annuities have the capacity for higher revenues, however there's more danger that you'll shed cash. Be cautious about placing all your assets into an annuity.

Take time to determine (annuity withdrawal calculator). Annuities sold in Texas must have a 20-day free-look period. Substitute annuities have a 30-day free-look period. During the free-look period, you may terminate the agreement and get a complete reimbursement. A financial advisor can assist you evaluate the annuity and contrast it to various other investments.

Whether you'll lose any incentive rate of interest or features if you offer up your annuity. The guaranteed interest rates of both your annuity and the one you're considering replacing it with.

Ensure any agent or company you're considering getting from is accredited and solvent. annuity withdrawal rules. To validate the Texas permit condition of a representative or business, call our Customer service at 800-252-3439. You can likewise use the Company Lookup function to discover a firm's financial rating from an independent score organization

There are three types of annuities: fixed, variable and indexed. With a fixed annuity, the insurance policy company ensures both the price of return (the interest price) and the payment to the financier.

Annuity Period

With a deferred set annuity, the insurance provider accepts pay you no much less than a specified rate of interest as your account is expanding (certain and life annuity). With an instant fixed annuityor when you "annuitize" your postponed annuityyou obtain an established set quantity of cash, typically on a month-to-month basis (similar to a pension plan)

And, unlike a fixed annuity, variable annuities don't offer any type of guarantee that you'll gain a return on your financial investment. Instead, there's a threat that you can actually lose cash.

Due to the intricacy of variable annuities, they're a leading source of investor complaints to FINRA (deferred annuity rates). Before getting a variable annuity, meticulously reviewed the annuity's prospectus, and ask the person offering the annuity to explain all of the product's features, motorcyclists, prices and restrictions. You need to likewise recognize exactly how your broker is being compensated, including whether they're receiving a payment and, if so, just how much

Retirement Income Annuities

Indexed annuities are complicated monetary instruments that have attributes of both fixed and variable annuities. Indexed annuities generally use a minimal guaranteed rate of interest integrated with a rates of interest linked to a market index. Numerous indexed annuities are tied to broad, widely known indexes like the S&P 500 Index. Some usage other indexes, including those that represent other sectors of the market.

Understanding the features of an indexed annuity can be complicated (best paying annuity). There are several indexing approaches firms make use of to determine gains and, due to the variety and complexity of the methods used to credit history interest, it's hard to contrast one indexed annuity to one more. Indexed annuities are normally classified as one of the adhering to 2 kinds: EIAs use a guaranteed minimum rate of interest (usually a minimum of 87.5 percent of the premium paid at 1 to 3 percent interest), along with an added rate of interest linked to the efficiency of one or more market index

5. The S&P 500 Index includes 500 large cap supplies from leading firms in leading industries of the United state economic climate, recording about 80% insurance coverage of United state equities. The S&P 500 Index does not consist of rewards declared by any of the companies in this Index.

The LSE Group makes no insurance claim, forecast, warranty or representation either as to the results to be acquired from IndexFlex or the suitability of the Index for the purpose to which it is being placed by New york city Life. Variable annuities are long-lasting economic products utilized for retired life savings. There are fees, costs, restrictions and threats related to this plan.

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Withdrawals may be subject to common income taxes and if made prior to age 59 may be subject to a 10% IRS charge tax. This product is general in nature and is being given for informational purposes only.

The prospectuses include this and other info concerning the item and underlying investment options. Please check out the programs very carefully before spending. Products and attributes are available where accepted. In many jurisdictions, the plan kind numbers are as follows (state variations might use): New York Life IndexFlex Variable AnnuityFP Collection (ICC20V-P02 or it might be NC20V-P02).

Purchase Annuity From 401k

A revenue annuity begins distributing repayments at a future day of your choice. Usually, you make a solitary lump-sum payment (or a series of settlements) and wait until you prepare to start getting income. The longer your cash has time to grow, the higher the revenue payments will be. Dealt with deferred annuities, additionally called dealt with annuities, give stable, surefire development.

The value of a variable annuity is based on the performance of an underlying profile of market investments. should i purchase an annuity. Variable annuities have the advantage of providing more choices in the method your money is spent. This market direct exposure may be required if you're seeking the opportunity to grow your retirement savings

This material is for details usage only. It ought to not be depended on as the basis to buy a variable, fixed, or prompt annuity or to implement a retirement strategy. The info provided here is not composed or meant as investment, tax obligation, or lawful recommendations and may not be relied on for objectives of avoiding any type of federal tax obligation fines.

Tax results and the appropriateness of any kind of product for any kind of certain taxpayer may vary, relying on the specific set of truths and circumstances. Entities or individuals distributing this details are not authorized to give tax or lawful guidance. People are encouraged to look for certain guidance from their personal tax obligation or lawful guidance.

Variable annuities and their underlying variable financial investment alternatives are marketed by syllabus just. Capitalists should consider the investment objectives, threats, charges, and expenditures thoroughly before spending. annuity financial.

Annuity Marketing Services

Fixed and variable annuities are released by The Guardian Insurance & Annuity Company, Inc. (GIAC). Variable annuities are issued by GIAC, a Delaware corporation, and distributed by Park Method Stocks LLC (PAS).

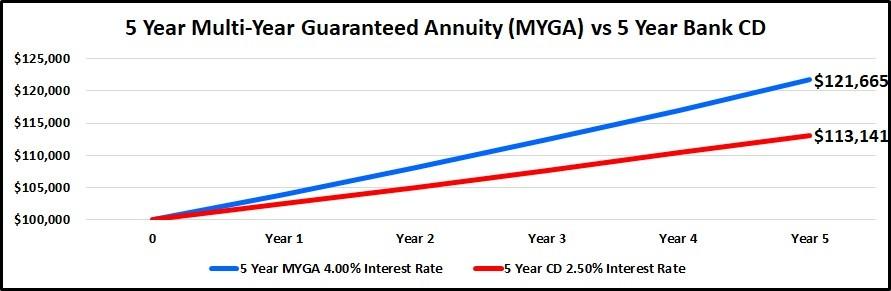

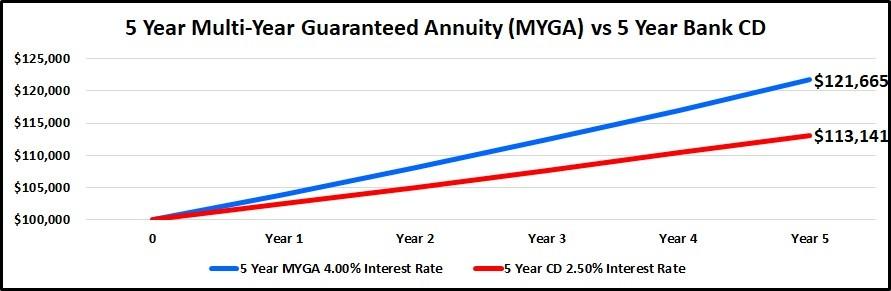

5 Enjoy out for dealt with annuities with a minimal guaranteed passion price of 0%. See out for advertisements that show high rate of interest prices.

Some annuities offer a greater ensured rate of interest for the very first year just. This is called an intro price. The interest decreases after that. Ensure to ask what the minimum price is and just how long the high rates of interest lasts. There are various means to start obtaining income settlements.

Accumulation Period Annuity

You generally can not take any type of money out. The main factor to buy a prompt annuity is to get a normal earnings as soon as possible in your retired life. Deferred Annuity: You begin getting income lots of years later on, when you retire. The major factor to acquire a deferred annuity is to have your money grow tax-deferred for some time.

This material is for informative or instructional objectives only and is not fiduciary financial investment suggestions, or a safeties, investment strategy, or insurance coverage item suggestion. This material does not take into consideration an individual's own goals or conditions which must be the basis of any financial investment choice. Financial investment items may undergo market and various other threat elements.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choosing the Right Fi

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Defining Fixed Interest Annuity Vs Variable Investment Annuity Features of Smart Investmen

Analyzing Strategic Retirement Planning Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial O

More

Latest Posts