All Categories

Featured

Table of Contents

The inquirer represents a customer who was a plaintiff in an injury matter that the inquirer settled on behalf of this complainant. The accuseds insurance firm consented to pay the plaintiff $500,000 in a structured settlement that requires it to acquire an annuity on which the complainant will certainly be detailed as the payee.

The life insurance coverage firm releasing the annuity is a qualified life insurance policy firm in New York State. N.Y. Ins. annuity account. Regulation 7702 (McKinney 2002) states in the appropriate part that" [t] he objective of this write-up is to provide funds to safeguard citizen. recipients, annuitants, payees and assignees of.

annuity contracts,. released by life insurance policy firms, based on specific restrictions, versus failing in the performance of contractual obligations as a result of the impairment of bankruptcy of the insurance provider releasing such. contracts." N.Y. Ins. Regulation 7703 (McKinney 2002) states in the relevant part that" [t] his write-up shall apply to.

N.Y. Ins. The Division has reasoned that an annuitant is the possessor of the basic right provided under an annuity contract and stated that ". NY General Guidance Opinion 5-1-96; NY General Advice Opinion 6-2-95.

Annuity Benefits

Although the proprietor of the annuity is a Massachusetts corporation, the designated beneficiary and payee is a local of New york city State. Since the above specified purpose of Short article 77, which is to be liberally understood, is to protect payees of annuity contracts, the payee would be secured by The Life insurance policy Business Warranty Firm of New York.

* An instant annuity will certainly not have an accumulation phase. Variable annuities released by Protective Life Insurance Company (PLICO) Nashville, TN, in all states except New York and in New York by Safety Life & Annuity Insurance Policy Firm (PLAIC), Birmingham, AL.

Compare Fixed Annuity Rates

Investors must meticulously consider the investment goals, risks, charges and costs of a variable annuity and the underlying investment alternatives prior to spending. This and other information is contained in the programs for a variable annuity and its underlying investment options. Syllabus may be acquired by getting in touch with PLICO at 800.265.1545. long term annuity. An indexed annuity is not an investment in an index, is not a protection or stock exchange investment and does not participate in any type of stock or equity financial investments.

The term can be 3 years, 5 years, 10 years or any type of number of years in between. A MYGA works by linking up a swelling amount of cash to permit it to collect interest.

Annuities Guaranteed Income

If you pick to renew the agreement, the interest rate may differ from the one you had originally agreed to. One more option is to transfer the funds into a various kind of annuity. You can do so without dealing with a tax obligation fine by utilizing a 1035 exchange. Since passion prices are established by insurer that sell annuities, it is necessary to do your study prior to signing an agreement.

They can defer their tax obligations while still utilized and not in need of extra taxed revenue. Offered the existing high rates of interest, MYGA has actually ended up being a considerable part of retirement financial preparation - annuitant vs owner. With the possibility of interest price decreases, the fixed-rate nature of MYGA for an established variety of years is highly interesting my clients

MYGA prices are generally greater than CD rates, and they are tax obligation deferred which further improves their return. A contract with even more restricting withdrawal provisions might have higher prices. Many annuity companies deal penalty-free withdrawal stipulations that enable you to take out some of the money from an annuity prior to the surrender duration finishes without having to pay charges.

In my viewpoint, Claims Paying Capability of the service provider is where you base it. You can look at the state warranty fund if you desire to, but keep in mind, the annuity mafia is viewing.

They understand that when they place their money in an annuity of any kind, the firm is going to back up the case, and the market is supervising that also. Are annuities guaranteed? Yeah, they are. In my opinion, they're safe, and you must go into them considering each carrier with self-confidence.

If I put a recommendation in front of you, I'm also putting my license on the line. I'm extremely positive when I placed something in front of you when we talk on the phone. That doesn't suggest you have to take it.

Guarantee Annuities

We have the Claims Paying Capability of the carrier, the state guaranty fund, and my buddies, that are unidentified, that are circling around with the annuity mafia. That's an accurate response of somebody who's been doing it for an extremely, really lengthy time, and who is that a person? Stan The Annuity Guy.

Individuals typically buy annuities to have a retirement earnings or to develop savings for one more function. You can purchase an annuity from a certified life insurance policy representative, insurance firm, monetary planner, or broker. You ought to speak with a monetary consultant concerning your requirements and objectives before you get an annuity.

Annuity Online Quote

The distinction between both is when annuity payments begin. allow you to save money for retired life or various other reasons. You don't have to pay taxes on your revenues, or payments if your annuity is a specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT), until you take out the profits. permit you to develop a revenue stream.

Deferred and instant annuities supply numerous alternatives you can select from. The alternatives provide various degrees of possible risk and return: are assured to make a minimum rate of interest. They are the most affordable monetary threat yet supply lower returns. make a greater rates of interest, yet there isn't an assured minimum rate of interest (what is an annuity and how do they work).

Variable annuities are greater threat since there's a chance you might lose some or all of your money. Set annuities aren't as risky as variable annuities due to the fact that the financial investment danger is with the insurance coverage company, not you.

Annuity For Dummies

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Set annuities ensure a minimum passion rate, typically between 1% and 3%. The business could pay a higher rate of interest price than the guaranteed rate of interest price.

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are more complicated than fixed deferred annuities.

Each relies on the index term, which is when the firm determines the passion and debts it to your annuity. The identifies just how much of the increase in the index will be used to determine the index-linked passion. Various other important attributes of indexed annuities include: Some annuities top the index-linked passion rate.

The flooring is the minimal index-linked rates of interest you will certainly gain. Not all annuities have a floor. All repaired annuities have a minimum surefire value. Some firms utilize the standard of an index's worth instead of the worth of the index on a defined date. The index averaging might occur any type of time during the regard to the annuity.

Various other annuities pay compound passion during a term. Substance rate of interest is rate of interest made on the money you conserved and the interest you gain.

Annuity Distributions

This percentage could be made use of rather of or in addition to an engagement price. If you take out all your cash prior to the end of the term, some annuities will not attribute the index-linked interest. Some annuities may credit only component of the interest. The percentage vested typically increases as the term nears the end and is constantly 100% at the end of the term.

This is since you birth the investment danger instead than the insurer. Your representative or monetary consultant can help you determine whether a variable annuity is appropriate for you. The Stocks and Exchange Payment identifies variable annuities as protections because the performance is stemmed from supplies, bonds, and other financial investments.

Annuity Meaning In Finance

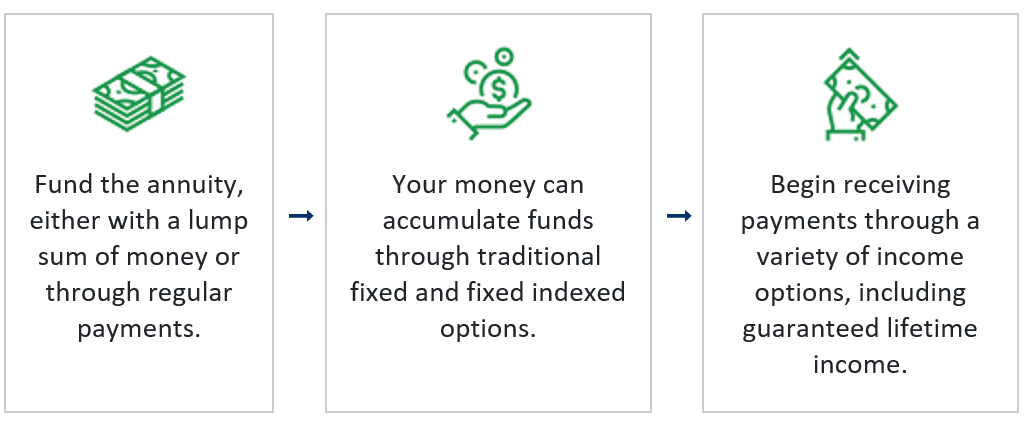

An annuity contract has two phases: an accumulation stage and a payout phase. You have several choices on how you contribute to an annuity, depending on the annuity you get: allow you to select the time and amount of the payment.

The Internal Earnings Solution (IRS) controls the taxes of annuities. If you withdraw your profits before age 59, you will possibly have to pay a 10% very early withdrawal charge in enhancement to the taxes you owe on the passion earned.

After the buildup phase finishes, an annuity enters its payment phase. This is sometimes called the annuitization phase. There are several alternatives for getting settlements from your annuity: Your business pays you a dealt with quantity for the time mentioned in the contract. The company pays to you for as lengthy as you live, however there are not any settlements to your heirs after you die.

Several annuities bill a fine if you take out money before the payment phase. This fine, called an abandonment cost, is typically highest in the early years of the annuity. The cost is commonly a percent of the taken out money, and usually starts at around 10% and goes down every year until the abandonment duration is over.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choosing the Right Fi

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Defining Fixed Interest Annuity Vs Variable Investment Annuity Features of Smart Investmen

Analyzing Strategic Retirement Planning Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial O

More

Latest Posts